CO DoR DR 1093 2020-2024 free printable template

Show details

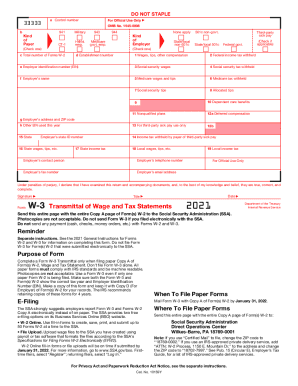

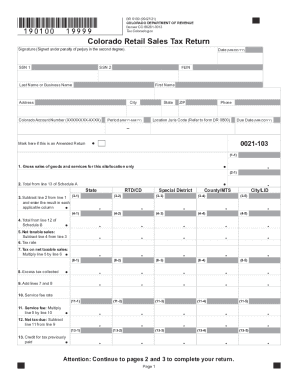

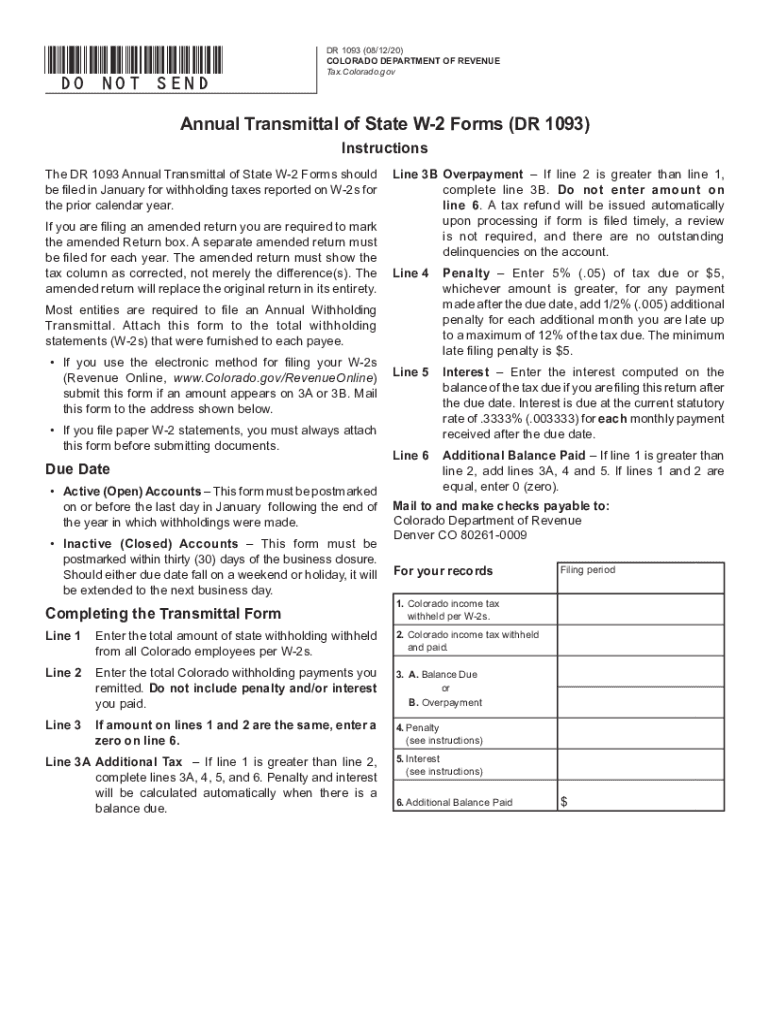

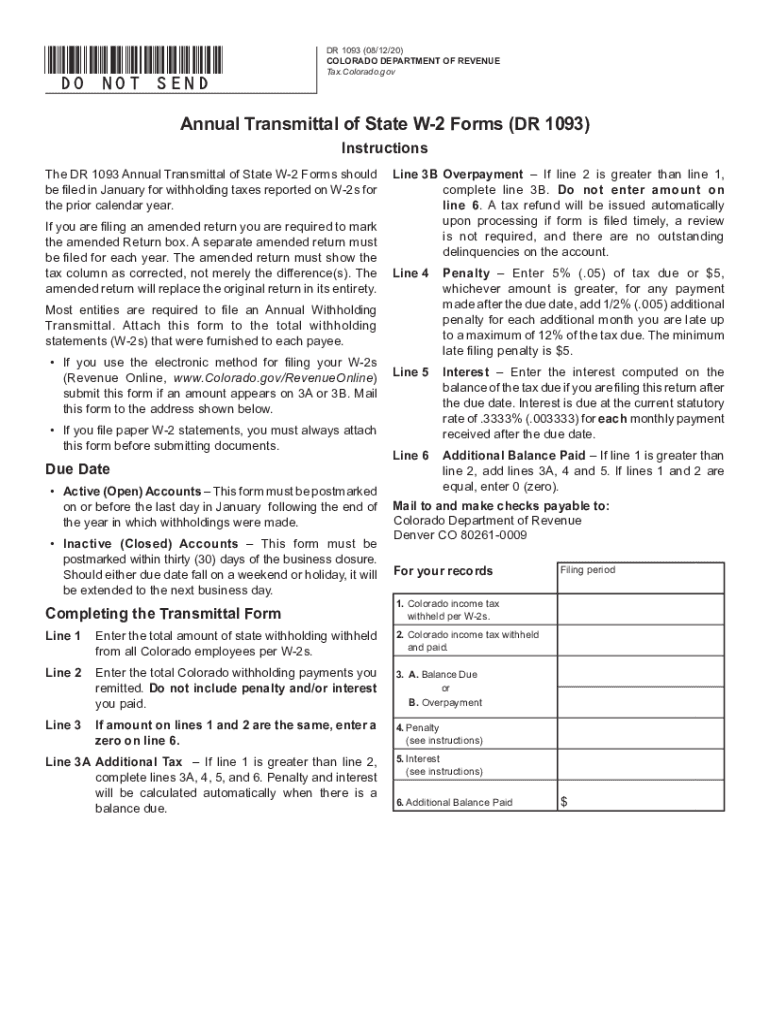

DO NOT SEND DR 1093 11/21/17 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0009 Colorado. gov/Tax Annual Transmittal of State W-2 Forms DR 1093 Instructions See form on page 2 The DR 1093 Annual Transmittal of State W-2 Forms should be filed in January for withholding taxes reported on W-2s for the prior calendar year. If you are filing an amended return you are required to mark the amended Return box. A separate amended return must be filed for each year. The amended return must show the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dr 1093 colorado 2020-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 1093 colorado 2020-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dr 1093 colorado 2023 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit colorado revenue form dr. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

CO DoR DR 1093 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dr 1093 colorado 2020-2024

How to fill out Colorado Revenue DR:

01

Obtain the Colorado Revenue DR form from the Colorado Department of Revenue website or request a copy by mail.

02

Read through the instructions provided with the form to understand the requirements and gather the necessary information and documentation.

03

Begin by entering your personal information, such as your name, address, and Social Security number, in the designated fields.

04

Provide details about your income, including sources of income, wages, tips, and any deductions or credits you may qualify for. Be accurate and include all relevant information.

05

Report any taxable interest, dividends, or capital gains that you may have earned during the tax year. Ensure that you have the necessary documentation to support your claims.

06

If you are claiming any dependents, provide their details, including their names, Social Security numbers, and relationship to you.

07

Calculate your total tax liability using the instructions provided and the information you have entered on the form. Be thorough and double-check your calculations.

08

If you owe any additional tax, ensure that you include the payment with your completed form. You can do this through various payment methods, such as electronic funds transfer or by mailing a check.

09

Review the completed form and ensure that all sections are accurately filled out. Make copies for your records before submitting it to the Colorado Department of Revenue.

10

Keep a copy of the submitted form and any supporting documentation for your records.

Who needs Colorado Revenue DR:

01

Individuals who have earned income in Colorado during the tax year are required to file a Colorado Revenue DR form.

02

Residents of Colorado who have reached the state's filing threshold, regardless of their income source, are also obligated to file this form.

03

Non-residents of Colorado who have earned income from Colorado sources and meet specific filing requirements must also fill out the Colorado Revenue DR form.

Video instructions and help with filling out and completing dr 1093 colorado 2023

Instructions and Help about colorado form dr 1093 printable

Fill form dr 1093 : Try Risk Free

People Also Ask about dr 1093 colorado 2023

What is a Colorado DR 1093?

What is dr 4709 colorado department of revenue?

Where do I mail my Colorado extension?

How much is Colorado withholding tax?

How do I submit tax withholding?

Where do I mail my DR 1093 Colorado?

What is the 2% withholding tax in Colorado?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file colorado revenue dr?

Anyone who has taxable income from Colorado sources must file a Colorado state income tax return. This includes individuals, corporations, trusts, estates, and partnerships.

What is the purpose of colorado revenue dr?

The Colorado Department of Revenue (DR) is the primary agency in the state responsible for collecting taxes and administering the tax laws and regulations of Colorado. The DR also provides guidance to taxpayers and administers tax credits, exemptions, and other incentives to ensure that all taxes are collected in a fair and consistent manner.

What information must be reported on colorado revenue dr?

The Colorado Department of Revenue requires businesses to report income, sales, and use taxes. Businesses must also report employer withholding taxes, severance taxes, and other fees and taxes required by the state. Businesses must also submit any other tax returns and reports mandated by the Department of Revenue.

When is the deadline to file colorado revenue dr in 2023?

The deadline to file Colorado Revenue DR in 2023 is April 15, 2023.

What is the penalty for the late filing of colorado revenue dr?

The Colorado Department of Revenue (CDOR) imposes penalties for late filing. The penalty is 5% of the tax due for each month or fraction of a month that the return is late, up to a maximum of 25%. Additionally, there is a minimum penalty of $5 or the amount of tax due, whichever is greater.

What is colorado revenue dr?

Colorado Revenue DR likely refers to the Colorado Department of Revenue (DR). The department is responsible for collecting taxes, enforcing tax laws, and administering various programs and services related to revenue collection in the state of Colorado.

How to fill out colorado revenue dr?

To fill out Colorado Revenue DR form, follow these steps:

1. Obtain the form: Visit the official Colorado Department of Revenue website or contact your local tax office to obtain the DR form that you need to fill out. Ensure that you are using the correct form for your specific tax situation.

2. Provide personal information: Begin by providing your personal information such as your name, address, Social Security number, and filing status. Include any dependents or other individuals claimed on your tax return.

3. Report income: Fill in the appropriate sections to report your income. This may include wages, salaries, interest income, dividends, capital gains, self-employment income, rental income, unemployment compensation, or any other relevant sources of income. Ensure that you fill out each section accurately and include all necessary documentation or supporting forms when required.

4. Deductions and credits: Determine which deductions and credits you are eligible for and include them on the relevant sections of the form. Common deductions may include student loan interest, mortgage interest, medical expenses, or charitable contributions. Available credits could include child tax credit, earned income credit, education credits, or dependent care credit. Review the instructions provided with the form to determine which deductions and credits apply to your situation.

5. Calculate taxes: Use the provided worksheets or tax tables to calculate your tax liability. Depending on your circumstances, you may need to calculate both state and federal taxes separately. Follow the instructions carefully and double-check your calculations to ensure accuracy.

6. Sign and submit: Once you have completed filling out the form, sign and date it. If you are filing jointly with your spouse, both of you must sign the form. Make a copy for your records and submit the original form to the designated tax office by mail or electronically, depending on your filing method.

Remember, it is always recommended to consult a tax professional or use an online tax filing software if you are unsure about any part of the process or have complex tax situations.

How can I manage my dr 1093 colorado 2023 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your colorado revenue form dr as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit colorado form dr 1093 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing dr 1093.

How do I edit colorado dr 1093 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as co dr 1093 form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your dr 1093 colorado 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Form Dr 1093 is not the form you're looking for?Search for another form here.

Keywords relevant to colorado revenue form dr 1093

Related to dr 1093 fillable form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.